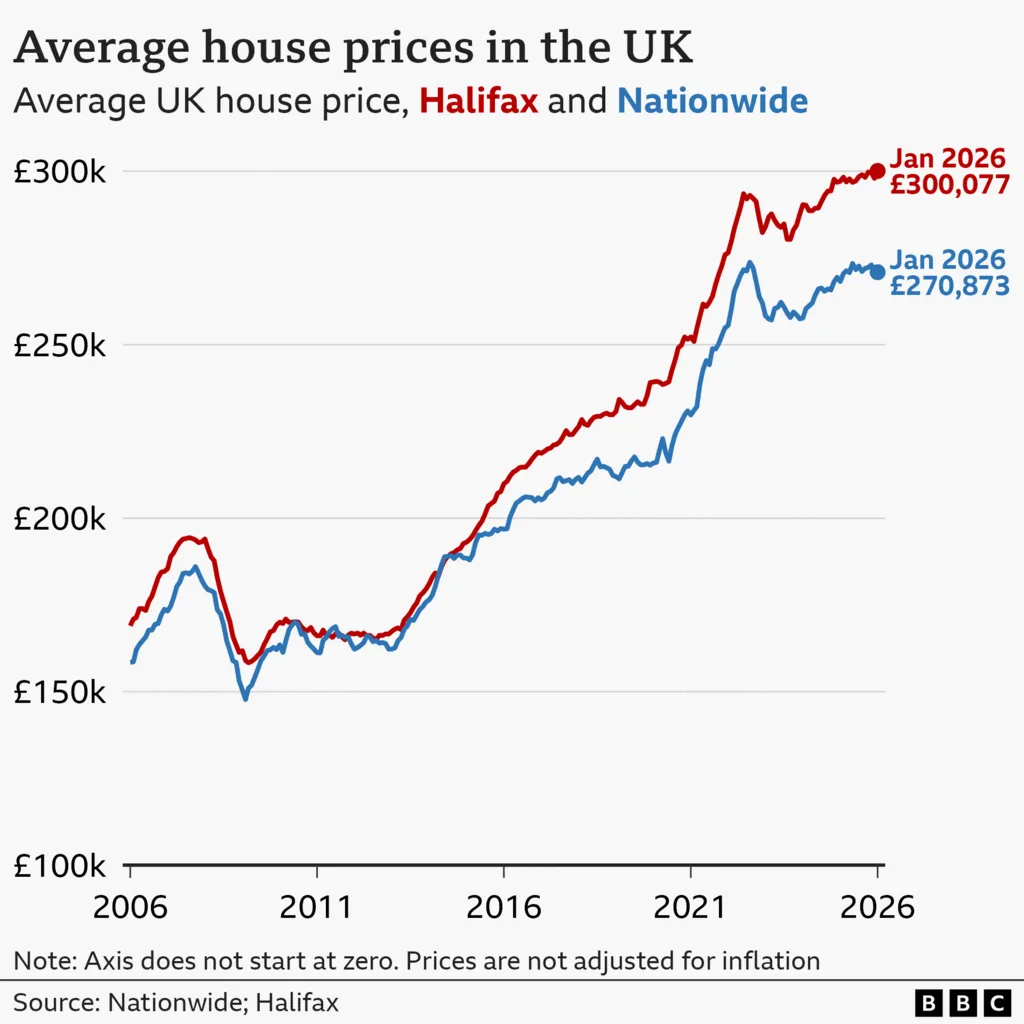

Average house prices have risen above £300,000 for the first time, according to Halifax.

The UK's biggest mortgage lender said the average UK property price rose to £300,077 in January - describing it as a "milestone" and potentially daunting for first-time buyers.

However, it said wage growth had outstripped house price inflation since 2022 which may help affordability.

Lenders have also been competing for first-time buyers in recent weeks by releasing products that require a smaller deposit.

On Thursday, the Bank of England hinted at interest rate cuts coming this year, which should also help to lower mortgage rates.

Karen Noye, mortgage expert at wealth management company Quilter, said that while average house prices crossing the £300,000 threshold might be good news for current homeowners, "it's yet another nail in the coffin for first‑time buyers already battling stretched affordability".

She said that while mortgage rates have been falling recently, "they are materially above the ultra-low levels people became used to over the previous decade".

"That shift continues to weigh on confidence, although at some point people will get used to this new normal and those rates become a pleasant but distant memory."

Halifax, which is part of Lloyds Banking Group, said house prices rose by 0.7% last month, reversing a 0.5% fall in December. Property values were up 1% from a year earlier.

House price surveys make their estimates in different ways, based on their own mortgage lending.

Average house prices, according to Halifax, are higher than many other surveys.

Earlier this week, rival lender Nationwide said house prices had risen by 0.3% in January to an average of £270,873.

According to the latest figures from the Office for National Statistics, average UK house prices stood at £271,000 in November last year.

Amanda Bryden, head of mortgages at Halifax, said the housing market had started the year on a "steady footing".

However, with the average price passing the £300,000 mark "affordability remains a challenge for many would-be buyers".

Despite this, she noted that wages have been rising faster than property prices since late 2022, "steadily improving underlying affordability".

"That's a positive trend for buyers, and the long-term health of the market," she said.

"We're now seeing more mortgage deals below 4%. If inflation continues to ease, there should be further gradual reductions as the year goes on."

She added that Halifax predicted house prices were "likely to edge up between 1% and 3% this year".

Amy Reynolds, head of sales at Richmond estate agency Antony Roberts, said Halifax's data reinforced what they were seeing: "Prices are broadly stable, with modest growth where supply is tight and homes are priced realistically.

"Activity since the start of the year has been noticeably stronger, and as we head into spring, that underlying demand is supporting prices rather than pushing them sharply higher."

If the Bank of England does cut rates later this year, Quilter's Noye says the impact on the housing market is "more likely to be gradual support for affordability rather than a sudden jump in prices".

"Stability has returned, but enthusiasm has not and that is likely to keep price growth contained over the months ahead," she said.

Gender pay gap won't close for

The average woman employee "effectively works for 47 days of the year for free," according to the Trades Union Congress.(0 )Readerstime:2026-02-15

Is dining out dying out?

The restaurant industry says it is facing a double whammy - rising costs and customers with less money.(2 )Readerstime:2026-02-14

Heathrow not crowded but peopl

Chief executive Thomas Woldbye says Europeans and Brits keep "crashing into each other" because they walk on different sides.(2 )Readerstime:2026-02-14

Inflation eases in US as price

Prices rose by 2.4% in the year to January, the latest official figures show, the slowest pace since May.(2 )Readerstime:2026-02-13Pinterest sacks engineers for

The social media platform recently announced that it was axing around 15% of its workforce.2026-02-04

The social media platform recently announced that it was axing around 15% of its workforce.2026-02-04Gold tops $5,000 for first tim

Gold is seen as a so-called safe-haven asset that investors buy in times of uncertainty and low interest rates.2026-01-26

Gold is seen as a so-called safe-haven asset that investors buy in times of uncertainty and low interest rates.2026-01-26Rise in half-term holiday book

Rain plus the political environment is creating a "powerful psychological need for escape", travel agents say.2026-02-13

Rain plus the political environment is creating a "powerful psychological need for escape", travel agents say.2026-02-13US launches plan to tackle Chi

The event was attended by representatives of more than 50 countries, the White House said.2026-02-05

The event was attended by representatives of more than 50 countries, the White House said.2026-02-05